Prices Fall AGAIN in Boise Idaho Housing Market September 2022

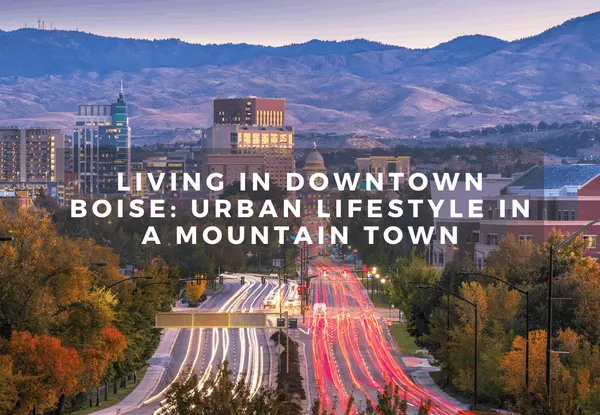

The Boise housing market is prime for the largest equity drop in the entire United States according to major outlets. Is this really true? Well, there's a lot of things happening in the Boise market right now and home prices are coming down. Plus we have major inflation going on and rising mortgage rates. What does all this mean for the Boise housing market and for you if you're looking at buying or selling a home here in the Boise in Treasure Valley area?

We are going to take a look at what's happening with the median home prices here in Ada County, which is the major Metro of Boise and including areas like Meridian, Eagle, Kuna, and Star.

First off, housing prices did slide this past month. They are down to $565,000 as a median price over all in the housing market. That's off of $590,000 just last month and off of a total high of $602,000 back in May. Overall we're down roughly 6% or so here in the Boise housing market in Ada County.

Let's take a quick look at neighboring Canyon County, which is essentially Nampa and Caldwell and Middleton. These areas have slidas well, they're down to $440,000. That's off a high of about $476,000 back in April. About over 5 months or so, we've come down about 6% as well as 7% in Canyon County.

What we're seeing right now in Canyon County is a stabilization of housing prices. They've basically been sitting right around $440,000 for the last few months. When you dive into existing sales versus new construction sales, things start to diverge a bit. In Canyon County actually it remains the same. Their median prices have not really moved around at all in the last couple months.

In Ada County, so that's Boise, Eagle, Meridian, etc, actually, existing sales fell the most. And new construction sales actually rose for a median price. New construction sales actually rose to $683,000 as a median sales price. That was up from around $670,000 the prior month. Existing sales fail about $19,000 down a little over 3%.

There's actually some discrepancies in the data that we're getting right now from the realtors association. And that is that it's showing about a 4% decline in housing prices, from the prior month for overall sales. But existing sales were down 3% exist, that's resell existing homes. And new construction are actually up a little bit.

The data doesn't quite line up yet. I think they got to clean that up a little bit and we'll get some more real data. I don't think that housing prices actually fell as much as what they're showing or there's so inconsistency with the new construction or existing sales data. That's actually some good signs that new construction is actually still faring very well.

And the interesting thing about new construction is that a lot of these folks have been under contract for a very long time, and there are penalties with getting out of those contracts. You have your earnest money deposit, which is typically non-refundable. And then, there will be liquidated damages that most of the builders put into the contract so that if you do back out the contract, they can come after you and get additional money for basically causing them harm.

A lot of people, even though the equity might be going down and they're thinking about backing out of the contracts, those extra costs are keeping them in the game and keeping them purchasing the home instead of backing out completely and throwing that home back on the market and reducing the sale.

People are negotiating price reductions right now on new construction homes as well and staying under contract. I actually think that's going to be a great stabilization for the Boise area housing market in general. And that's probably why you're seeing in Canyon County where a lot of new construction is happening. Not really seeing much price reductions happening because people are holding their contracts and actually are not falling out of contract.

For instance, Toll Brothers, a major luxury builder here in the area, they're going to take about a 5% earnest money deposit up front, and they're going to hit you for 5% liquidated damages on the back end if you choose to back out. If you're buying a $700,000 home from Toll Brothers, you're going to be on the hook for around $70,000. That's probably going to keep you in the game and actually continuing to purchasing that home.

I want to talk about the idea that Boise is primed for the biggest housing market dropped in the nation. Whether or not that's true, I can't exactly say, but I can compare it to some other areas. I actually operate here and also in San Diego and I run a team there and I'm very involved in looking at the data there and producing market updates exactly like this.

And actually what we're seeing in San Diego is a much larger drop then what we've experienced here in the Boise market. In San Diego, the median price was a $1 million and it's fallen down to $910,000 down 9% in just 5 months. That's the fall of 9% versus here in Boise where it's down about 6%, maybe 7%.

And as a dollar number much, much smaller from $602,000 to $565,000. Down only about $37,000 versus $90,000 in San Diego and 9%. That's just an example of, there's a lot of fear being propagated out there right now and that's because it drives viewership. It drives clicks on those headlines that scare people. And unfortunately it's causing people to actually then make decisions based off that, which may not actually be true.

I really, really encourage you to do on research, watch videos like this, to find out what is really happening. I'm not here to blow, smoke up you,. It's just to provide real information of what's actually happening and compare it so that you can already see Boise is not having the biggest equity drop in the nation.

A place like San Diego actually is having a very large equity drop. Just watch out for that before you go and make decisions and decide that, “oh, you know, I'm out of the Boise market because it's going down”. What I like to do is I like to look at a 10 year horizon minimum for any home that I'm looking at purchasing and what I advise my clients.

I like to look at it and say, “Hey, when I look back in 10 years and be happy that I purchased this home, will my equity have gained in 10 years”. Most people live in their homes at least 5-7 years. And actually over the last few years, that's risen to actually closer to 10 years that most people are staying in their homes.

That being said, you got to look back and say, “would I be happy having purchased that home?” Would my future self say, “I'm glad I bought that home for $500,000.

I lost $50,000 in equity, and now it's worth $800,000 today”.

That's how I look at it when I'm purchasing a home. And that's exactly what I did recently. When I bought a new construction home here in the Boise, Treasure Valley area. Let's take a look at mortgage rates because that's a big thing that's scaring people right now as well. Mortgage rates have been all over the map. Right now, they are sitting right around 6%.

The Fed is supposed to meet next week and everyone's expecting that the interest rates will rise another three quarters of a percent. As I mentioned, mortgage rates have been all over the map. They were down to around 5%, about a month ago, they began clicking back up.

And then in the last week, week and a half, actually they bounced all over the place going up and down by a quarter point every day. And so that's adding significantly to, of course the housing cost, the monthly mortgage payments that folks are having to pay.

If you are looking to buy, you need to lock in that mortgage rate as soon as possible, and hopefully have it floating so that it can go down if mortgage rates go down. But right now with inflation sitting right around 8.1% I think interest rates will continue to rise a little bit more. The three quarter percent interest rate rise will be very interesting to watch because it's actually, my guess just a guess, is that mortgage rates won't rise in the direct correlation to that Fed rate rise.

And that's because that Fed rate rise that is not tied to mortgage rates, mortgage rates in the Fed is not tied together. The Fed is tied to how much your bank account is paying out an interest. And then how much premium are people lending on top of that?

Your car payments, things like that, not actually tied to mortgage rates, mortgage rates are much more tied to inflation in a high inflationary environment environment.

They're almost directly correlated. In fact, I'm rather surprised that mortgage rates have not hit at least 8-10% already. And they're also tied to the bond market and the bond market's been going crazy.

We're waiting for the next consumer price index. The next CPI to drop tomorrow. People are expecting that to be rather negative. And that's probably going to drive mortgage rates up a little bit more. I'm expecting to see mortgage rates rise probably into the 6.5% to 7%, but we will just have to see what remains to be seen.

And that being said, what most people are predicting right now is that mortgage rates will actually fall heading into next year, probably back down into the 4.5% range. Even though mortgage rates are not directly tied to the Fed, their entire inflation, the Fed is trying to drive down inflation as causing damage to the economy in order to do this.

But because of that, hopefully someday inflation will drop. Who knows what's going to happen with everything that's been happening with all this inflationary, the inflation reduction act and the college debt forgiveness, it's going to add to inflation, but barring all that hopefully next year inflation does start to fall and that will cause mortgage rates to fall as well.

If you do lock in now and you purchase a home now, even at 6%, which is what I did then, you can refinance next year down in a f4.5% and save yourself a pretty significant amount of money. If you buy right now, I will just say, chances are you probably will lose equity. I myself bought.

I know that I'm probably going to lose equity. It actually appraised higher than what I purchased it at because I actually negotiated a price reduction for myself right out of the gate, right before not too long before closing, you can do that. If you're in new construction, you can negotiate with the builders. They are nervous right now and they do not want to lose contracts.

Even though they do have liquidity damages, they would prefer to sell the home versus sitting on that inventory. You have a lot of leverage. You can negotiate price reductions, and you can negotiate credits as well. Keep that in mind. I walked into theoretical equity in the home.

I don't believe that actually exists, and that is just me, but I, again, still went ahead and purchased because I believe in real estate as a great investment vehicle, overall. Personally, I will be holding this home probably forever. It will eventually become a rental at some point. And so I'm not really worried about the ups and downs in the market.

It's just like investing in stocks. If you're trying to day trade, then you're going to get burned. And but if you're investing for the long term, you're investing in index funds and you don't pull your money out whenever there's a downturn, you just let it ride over the long term. Stocks rise about eight to 10%. Well, that's just like real estate, real estate rises on average somewhere between 4-6% overall.

And that's actually where we're at right now. Year over year is a little over 6% appreciation. I think that will continue to drop slightly. But overall this year from where you were last year, you're still up about 6%. If you look at real estate as riding a long term game, you can ride those ups and downs and not worry about the dips and the ups.

And don't try to time the market perfectly. If you're trying to time the market, you're going to get burned. If you are looking to sell a home right now, here's the big thing you need to keep in mind is that you need to price aggressively in order to sell the home.

If you overprice your home based on prior, what was going on, your home is going to sit on the market for a very long time. And you're going to drive that price down, down, down. This is not like selling a car or used car. You don't start the price where you hope you can get it. And then go ahead and negotiate down.

You're going to lose a tremendous amount of money doing that. This is an auction style. How you want to sell your home price, it low price. It aggressively get maximum number of eyeballs on that home. There is a lot of data that shows that where you price the home, if you overprice, you're going to get very few buyers looking at it.

If you under price, you're going to have maximum number of buyers looking at that home, which then drives showings, which drives offers, which drive the price back up. If you're looking to sell a home price aggressively and let that price ride back up, but there are still active buyers in the market.

They have not all fled like what the news is saying. If you are looking to purchase a home, there is a lot more options for you available right now just a few months ago, it was absolutely terrible. There was no inventory you were throwing in offers and offers were being accepted, right out of the gate, without even showing through the weekend, or you were being bid with multiple, multiple offers, multiple counter offers.

And you're having to offer way over ask price and inventory is flying off the shelf and you couldn't do anything about it. And you just kind of got stuck with the house that you had to have. So right now, there certainly are a lot more options available for you if you're looking to buy a home, you can be a little bit more picky and you can negotiate with the sellers potentially for credits to buy down your interest rates so that you actually come in with a lower interest rate as well.

That's everything that's happening in the Boise housing market right now.

Curtis Chism, Realtor

208-510-0427 | Mobile

boise@chismteam.com

Chism Team | NRDS# SP56593

brokered by eXp Realty

Categories

Recent Posts